Learn how to change the existing tax rates for Tax codes by updating the underlying tax entities

The Tax Code % is equal to the sum all the the tax entity rates assigned to the tax code.

To edit a Tax Code, you must first edit the assigned tax entity

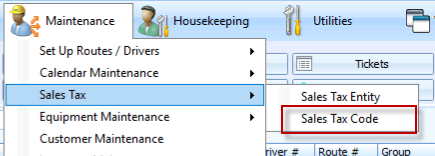

1. Find the Tax Code that will be changing (ServQuest > Maintenance > Sales Tax Code)

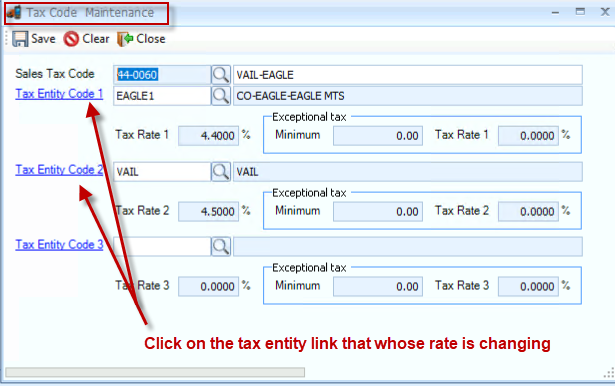

2. Find the tax code and click on the blue link of the Tax Entity assigned that is being changed

For creation of NEW Tax Codes or Entities, see this article

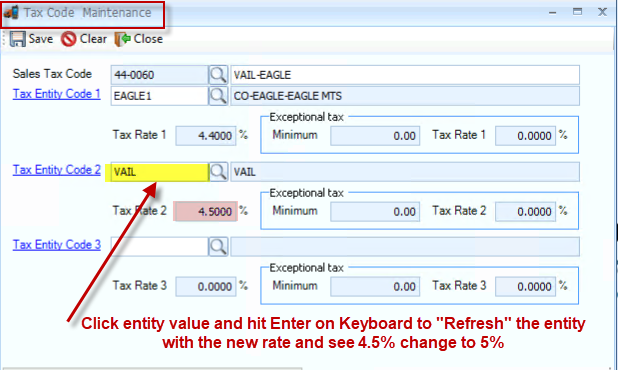

- This is Tax Code form for tax code 44-0060

- The tax rate is currently 8.9% (4.4% for eagle + 4.5% for vail)

- Click on the Tax Entity code whose rate is being changed

- In this example, only Vail is changing from 4.5% to 5%

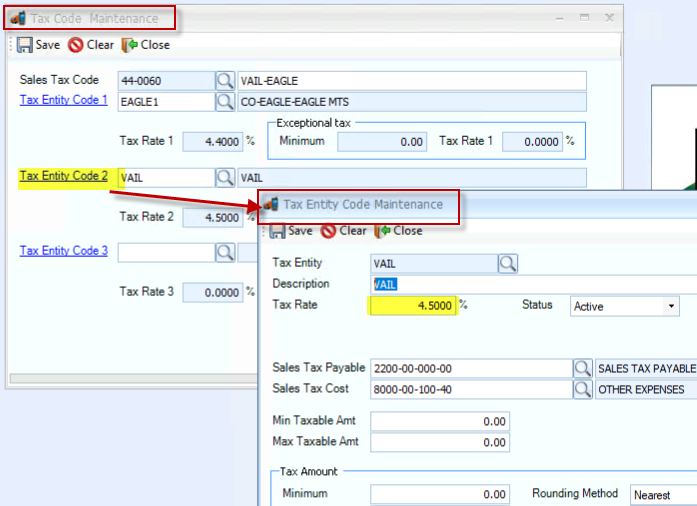

- Clicking the blue link will open the Tax Entity form for Vail

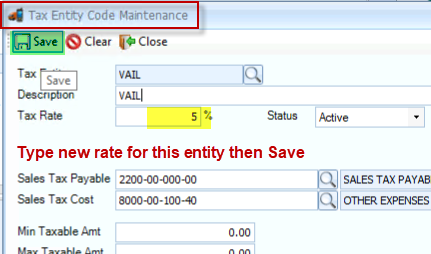

3. For the Vail Tax Entity, change the Rate to 5% then click Save and close

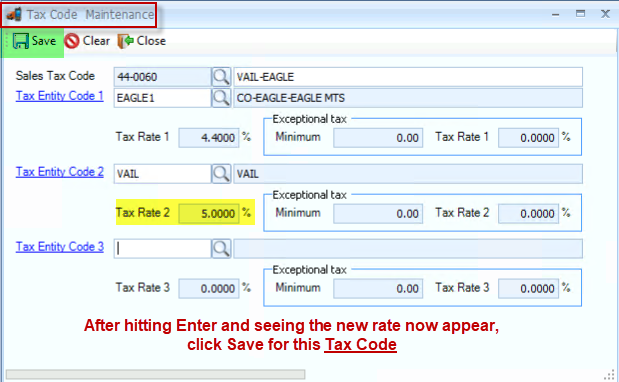

4. You should now be back on the Tax Code form

Note: You MUST re-validate the existing entity to see the new rate on this form!

- Click the entity value, in this case Vail, and hit Enter on your keyboard

- You should see the 4.5% change to the 5% after hitting Enter

5. Click Save

- The New Tax Rate for Tax Code 44-0060 is now 9.4% (4.4% for eagle + 5% for vail)

- Once a Tax Code rate is changed, any NEWLY GENERATED TICKETS after the change will reflect the new sales tax rate

- Any EXISTING tickets that were already generated prior to finishing Step 5 will reflect the "old" tax rate of 8.9%

- Any NEW tickets generated after Step 5 will automatically reflect the "new" tax rate of 9.4%